Think about a single health insurance claim for a moment. Let's trace the journey of that one claim form. It arrives, gets sorted, and then sits in a queue, waiting. Eventually, an employee has to pick it up, read it, and manually type all the data into another system. A single typo—a misspelled name or a transposed digit in a policy number—can send that entire claim right back to square one. This creates maddening delays for both patients and providers, damaging relationships and slowing down cash flow.

The direct costs, like employee hours spent on data entry, are easy enough to calculate. But it's the indirect costs that are far more insidious and damaging. Manual processes open the door to substantial risks that can seriously undermine an organization's financial stability and hard-earned reputation.

These risks aren't just hypotheticals; they're happening every day:

The real problem is that manual processing isn't just slow—it's a significant financial liability, a constant threat to data security, and a major barrier to scalable growth in a fiercely competitive market.

This is precisely why health insurance document automation is no longer a "nice-to-have" for forward-thinking organizations. It has become an urgent operational necessity for survival and growth. Without it, companies are left trying to manage a system that actively works against their own goals of efficiency, security, and customer satisfaction.

If your current document process feels like you're searching for a needle in a haystack, you know the daily frustration all too well. Now, imagine swapping that haystack for a digital library where every piece of information is instantly organized, searchable, and secure. That, in a nutshell, is health insurance document automation .

Think of it as a digital assembly line for your paperwork. When a new claim form arrives, instead of an employee manually typing everything into a database, an automation platform reads, understands, and sorts the information in seconds. This creates a smooth flow of data that’s faster, more accurate, and much more secure than any manual process.

Health insurance document automation isn't a single magic button. It’s an ecosystem of different tools all working together to turn chaotic paperwork into structured, valuable data. Let's look at the key players that make it all happen.

Getting started with health insurance document automation can be a gradual process. You might begin with something simple, like auto-filling forms where customer data is automatically pulled into a new policy document.

But the real magic happens when you weave these technologies together into a completely integrated system that manages entire workflows from start to finish. The automation of health insurance documents has become the go-to solution for the age-old problem of slow, error-prone claims processing.

Modern platforms like EDocGen give insurance companies the power to use low-code or no-code tools, meaning your own team—not just IT—can create and manage document workflows. With centralized templates, keeping up with changing healthcare regulations becomes simpler and less risky. This approach also tightens data security for rules like HIPAA and creates searchable databases so your team can find patient information in a flash.

An automated system doesn’t just digitize your existing process; it completely redesigns it for maximum efficiency, accuracy, and security.

This connected approach creates a seamless flow of information from the moment a patient walks in all the way to claims settlement. When you explore the specifics of insurance document generation , you see how automation pulls all these separate pieces into one cohesive, efficient machine. It’s in this unified environment that businesses really start to see a major return, turning a tedious cost center into a real strategic advantage.

While the tech behind automation is impressive, what really matters are the clear, measurable business outcomes. Bringing health insurance document automation into your operations isn't just about getting modern tools for the back office; it's a strategic move that delivers a powerful return on investment. It directly improves efficiency, strengthens your financials, and completely changes the experience for everyone involved.

Let's move past the theory. The impact isn't subtle—it’s a fundamental shift in how work gets done. Slow, manual tasks transform into fast, reliable workflows, allowing an insurance company not just to cut costs but to carve out a serious competitive edge.

The benefits really boil down to three key pillars: dramatic efficiency gains, significant financial returns, and a reinvented stakeholder experience. Each one builds on the other to create a healthier, more resilient business.

The first thing you'll notice is a massive boost in operational speed. Tasks that used to eat up weeks of manual effort can now be wrapped up in days, sometimes even hours. Take claims processing—a classic bottleneck in the insurance world.

Instead of a claim form sitting in an inbox waiting for someone to key in the data, an automated system extracts and validates everything instantly. That one change sends a positive ripple effect through the entire workflow, speeding up every step that follows.

Global workflow automation statistics show just how substantial these improvements are. Technologies like digital document processing and RPA can reduce claims processing times by as much as 50% . That acceleration directly leads to operational cost reductions of 20-30% by cutting down on manual work. You can explore the data behind workflow automation statistics to see the broader impact.

Before we dive into the financial returns, let's look at the numbers. The following table breaks down how automation can concretely improve key metrics across your organization.

Impact of Automation on Key Insurance Metrics

|

Area of Impact |

Metric Improvement |

Primary Technology Driver |

|

Claims Processing |

Up to 50% reduction in turnaround time |

Intelligent Document Processing (IDP), RPA |

|

Policy Administration |

30-40% decrease in policy issuance time |

Automated Document Generation, Digital Workflows |

|

Compliance & Reporting |

90% fewer errors in compliance documents |

Rule-based Automation, AI-powered Validation |

|

Fraud Detection |

Up to 50% faster identification of fraud |

AI/Machine Learning, Pattern Recognition |

|

Customer Onboarding |

60% faster new member onboarding |

Digital Forms, Automated Data Verification |

These figures aren't just hypotheticals; they represent real-world results that firms see when they commit to automating their core processes.

Beyond pure speed, automation makes a strong financial case. The most obvious win is lower labor costs. When you automate the repetitive, low-value work, your skilled employees are free to focus on what humans do best: managing complex cases, building provider relationships, and improving customer service.

This isn't about replacing people; it's about empowering them to do more valuable work that directly impacts the bottom line. This is a core idea behind effective enterprise document automation , where technology is there to augment human expertise, not supplant it.

Finally, the impact of automation reaches far beyond your office walls. It fundamentally changes the experience for your most important stakeholders: your patients and providers. For them, speed and clarity are what count.

When a provider can submit a claim and get paid quickly, it builds loyalty and strengthens your entire network. When a patient receives a clear, accurate Explanation of Benefits (EOB) right away, it builds trust and cuts down on confused, frustrated phone calls.

This improved experience is a massive differentiator. In an industry where customer service can be the deciding factor, offering a fast, transparent, and hassle-free process gives you a huge advantage. Your team is happier, your partners are more satisfied, and your members feel genuinely cared for.

To really get what health insurance document automation is all about, we need to pop the hood and see what makes the engine run. This isn't just one piece of technology; it's a powerful combination of tools working together like a well-oiled machine.

The whole journey from paper to pixels kicks off with Optical Character Recognition (OCR) . This is the foundational tech that creates a bridge between the physical world of faxes and forms and the digital world where software can work its wonders. OCR is what allows a computer to actually "read" text from a scanned document or even a picture from a phone.

Simply put, OCR is the front door for raw information. Without it, your automation efforts would stall before they even begin, leaving you with nothing more than a pile of unreadable images.

Once OCR has done its job and turned the paper into text, Robotic Process Automation (RPA) takes the baton. Think of RPA as a team of digital workers who are programmed to handle repetitive, rules-based tasks with perfect precision.

These software "bots" are the true workhorses of any automation system. We train them to do the specific, monotonous jobs that humans find boring and are likely to make mistakes on.

For instance, you can set up an RPA bot to:

RPA is brilliant at these kinds of structured tasks. It shuttles data between different applications and follows predefined steps flawlessly, which frees up your human team to focus on handling exceptions and making more complex judgment calls.

If OCR provides the eyes and RPA provides the hands, then Artificial Intelligence (AI) and Natural Language Processing (NLP) are the brain. This is where real intelligence comes into play, giving the system the ability to not just read data but to actually understand its meaning and context. This is absolutely essential in healthcare, where information is rarely black and white.

AI elevates the process from simple data entry to genuine data interpretation. It can make sense of unstructured text, like a doctor's narrative notes or a complex medical history, and pull out the crucial details needed to process a claim.

Artificial intelligence has completely changed the game for health insurance claims processing, automating manual steps with breathtaking speed and accuracy. Today's AI-driven solutions use sophisticated NLP algorithms to review complex medical documents—like physician notes or diagnostic reports—with up to 95% accuracy . This slashes the need for manual data entry, cutting claim processing times from days down to just minutes.

Thanks to this level of automation, routine claims can fly through the system on their own, letting your specialists dedicate their expertise to the tricky cases that truly need a human eye.

For example, an NLP model can analyze a radiologist’s report on an MRI, pinpoint the specific findings, and automatically suggest the right medical codes. This intelligent interpretation leads to better accuracy, faster approvals, and helps catch discrepancies a simple, rule-based system would have missed entirely. It’s this layer of intelligence that makes modern health insurance document automation so incredibly powerful.

Taking on any new technology can feel like a huge project, but with the right plan, what seems overwhelming becomes a series of simple, manageable steps. When it comes to health insurance document automation , a solid, structured approach is what separates a frustrating project from one that unlocks real value without derailing your operations.

Think of this as a planned expedition, not a blind leap of faith. Each phase builds on the last, helping you gain momentum, prove the value to your team, and bring everyone along for the journey. Following a clear path helps you sidestep the usual traps and ensures your automation efforts start paying off right away.

Phase 1: Assess Your Current Workflows

Before you can automate a single thing, you need a crystal-clear picture of what you're doing right now. This first phase is all about taking inventory of your document-heavy processes. The goal here is simple: find the biggest bottlenecks, the most error-prone tasks, and the spots where automation will make the biggest, fastest difference.

Start by picking one key workflow, like claims intake or new member onboarding. Literally follow a document from the moment it arrives to the moment it's filed away.

This audit will hand you a concrete list of opportunities. You might find that 80% of your processing delays are tied to manually checking provider details—an absolute perfect candidate for automation.

Phase 2: Select the Right Automation Partner

Once you know exactly what you need, you can start looking for a technology partner. The right company will do more than just sell you software; they'll act as a guide. Choosing a platform like EDocGen , which is designed for business users, means your team can actually own the automation process without being completely dependent on the IT department.

When you're looking at different solutions, don't get lost in a long list of features. Focus on what actually matters for long-term success.

Your vendor is more than a supplier; they are a critical component of your automation strategy. The right partnership is built on technology that is powerful yet accessible, secure, and capable of growing with your organization.

Here’s what you should be looking for:

Phase 3: Plan a Phased Rollout

Trying to automate everything at the same time is a classic mistake and a recipe for disaster. A much smarter way to go is a phased rollout, kicking things off with a pilot project. Pick one of those high-impact, low-complexity workflows you found during your assessment. This first project is your proof-of-concept.

By starting small, you can get a tangible win on the board quickly, which builds excitement and gives you critical lessons for the wider rollout. A successful pilot creates internal champions who will naturally advocate for using it more broadly.

Once that pilot is a proven success, you can methodically expand health insurance document automation to other departments and more complex workflows, using your first win as the blueprint. This step-by-step process keeps risk low and makes the transition smoother for everyone.

To really grasp what health insurance document automation can do, you have to see it in action. Let’s look at how it completely overhauls the core processes you deal with every day.

The goal isn't just about scanning paperwork; it’s about fundamentally rebuilding these workflows for peak efficiency and reliability. By digging into a few specific examples, we can paint a clear "before and after" picture. You'll see exactly where the value comes from and what it means for your teams on the ground.

The biggest and most immediate impact is almost always in claims processing. Before automation, handling a simple CMS-1500 form is a manual slog. Someone on your team gets the form, squints at it, types the data into the system, and passes it along. It’s slow, tedious, and a breeding ground for typos that lead to costly claim rejections.

Now, imagine this with automation. The moment a scanned form hits the system, the software takes over. Optical Character Recognition (OCR) instantly pulls all the key data—patient details, provider info, medical codes. It then cross-checks this information against your records, flags any weird discrepancies for a human to quickly review, and sends the clean claim straight to adjudication. The entire data entry step just vanishes.

Patient onboarding is another area just begging for an upgrade. Think about the old way: manually putting together and mailing welcome kits, policy documents, and other initial communications. It's time-consuming, expensive, and every document is a chore to customize, print, and stuff into an envelope.

Automation makes this process instant and deeply personal. When a new member joins, a workflow kicks off that automatically generates a complete, personalized welcome kit. The system uses conditional logic to pull in the right benefit details or state-specific disclosures for that member. These documents can be fired off via email or sent to a print vendor without anyone lifting a finger.

This level of automation means every new member receives accurate, tailored, and timely information from day one, setting a positive tone for the entire relationship.

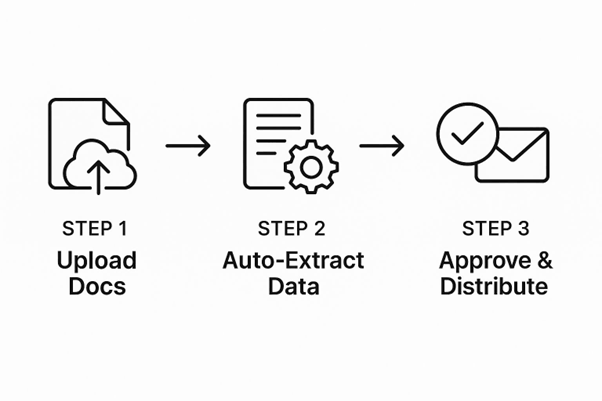

This simple flow shows how automation cuts out the manual touchpoints, speeding up the entire journey from a raw document to the finished product.

As the infographic shows, it’s a logical path where automation removes the roadblocks, accelerating the whole document lifecycle.

Generating an Explanation of Benefits (EOB) is notoriously complex. It involves mashing together data from multiple places to create a statement that, frankly, most members find confusing. An automated system, on the other hand, can pull the claims data, apply policy rules, and generate a clear, easy-to-read EOB in a standard format. This alone can dramatically cut down on inbound calls from frustrated members. These kinds of improvements are a core part of the broader healthcare IT services transformation happening across the industry.

Provider credentialing is another perfect candidate. Instead of having staff spend countless hours manually checking state licensing boards and other databases, you can program bots to do it for you. They’ll check credentials, verify licenses, and flag any issues that need a human eye, freeing up your team for more important work.

If you want to get into the nitty-gritty of how this technology works, you can read our complete guide on document automation for more insights.

This is usually the first question on everyone's mind, and for good reason. Protecting patient data isn't just a priority; it's a must. The good news is that modern automation platforms are built from the ground up with security at their core, not as an add-on. They use several layers of defense to make sure HIPAA compliance is rock-solid.

Here’s how they do it:

Yes, and they're built to do it smoothly. A good automation platform is designed to be a team player, not a lone wolf. It needs to connect with the software you already rely on every day, whether that's your core claims management system or your CRM.

This connection happens through what’s called an Application Programming Interface (API) . An API is like a secure translator that lets different software programs talk to each other and share data automatically. It means you don't have to rip out and replace what's already working. The automation tool simply plugs into your current setup.

Not like you used to. One of the biggest game-changers in automation is the rise of no-code platforms . These tools are built for the people on the front lines—the business users—not just for developers.

Ready to see how EDocGen can answer your organization's specific automation needs? and discover how our no-code platform empowers your business users to build secure, compliant, and efficient document workflows.