Insurance Documents Automation

Insurance is a highly regulated, document-intensive business. Whether you're in health, travel, property & casualty, or any other specialized sector, the sheer volume and complexity of documentation can be a significant drag on efficiency, profitability, and customer satisfaction.

Using Insurance Document Automation Software can help streamline the creation, customization, and delivery of essential documents while ensuring regulatory compliance. Regulators have a great say in what and how insurers convey information to their customers. For example, the Insurance Conduct of Business Guidelines (ICOB) has a direct impact on the content and presentation. Also, EU-wide regulations require insurance firms to create Key Information Documents (KIDs) that outline the risks and costs of the investment in the customer’s language.

Hence, insurers face a need to

-

Tightly track and manage every document, including slips, quotes, policies, and contracts.

-

Stay in compliance with the ever-changing standards, market and governmental regulations.

-

Remain competitive in a digital-first world.

SCHEDULE DEMO

Insurance companies send documents for underwriting, rating, quoting, policy, etc., to their customers. These documents are critical in conveying information and maintaining the insurer's brand. Manual creation of appealing, accurate, and compliant customer-facing documents is error-prone and costly. This increases the risk of errors and results in inefficient QA checks.

The retail network, consisting of advisors and field staff, is the growth engine for insurers. To run their business efficiently, insurers must make themselves more productive during presales. They should be able to retrieve data from different Enterprise systems to perform risk and performance scenario calculations and cost breakdowns.

Every minute spent on creating documents is a non-productive minute not spent on evaluation and selling. Re-keying data at various points in the process wastes time and resources.

Automate Insurance document generation

To address the above, insurers are adopting document automation solutions. These solutions auto-generate documents from disperate Enterprise data sources and applications. Thus, they eliminate manual data entry. It produces compliant documents and removes expensive QA checks.

The policy administration process, from application to claim processing, can be managed through automation. The end goal is to provide quick service at a high level of quality that complies with existing legislation.

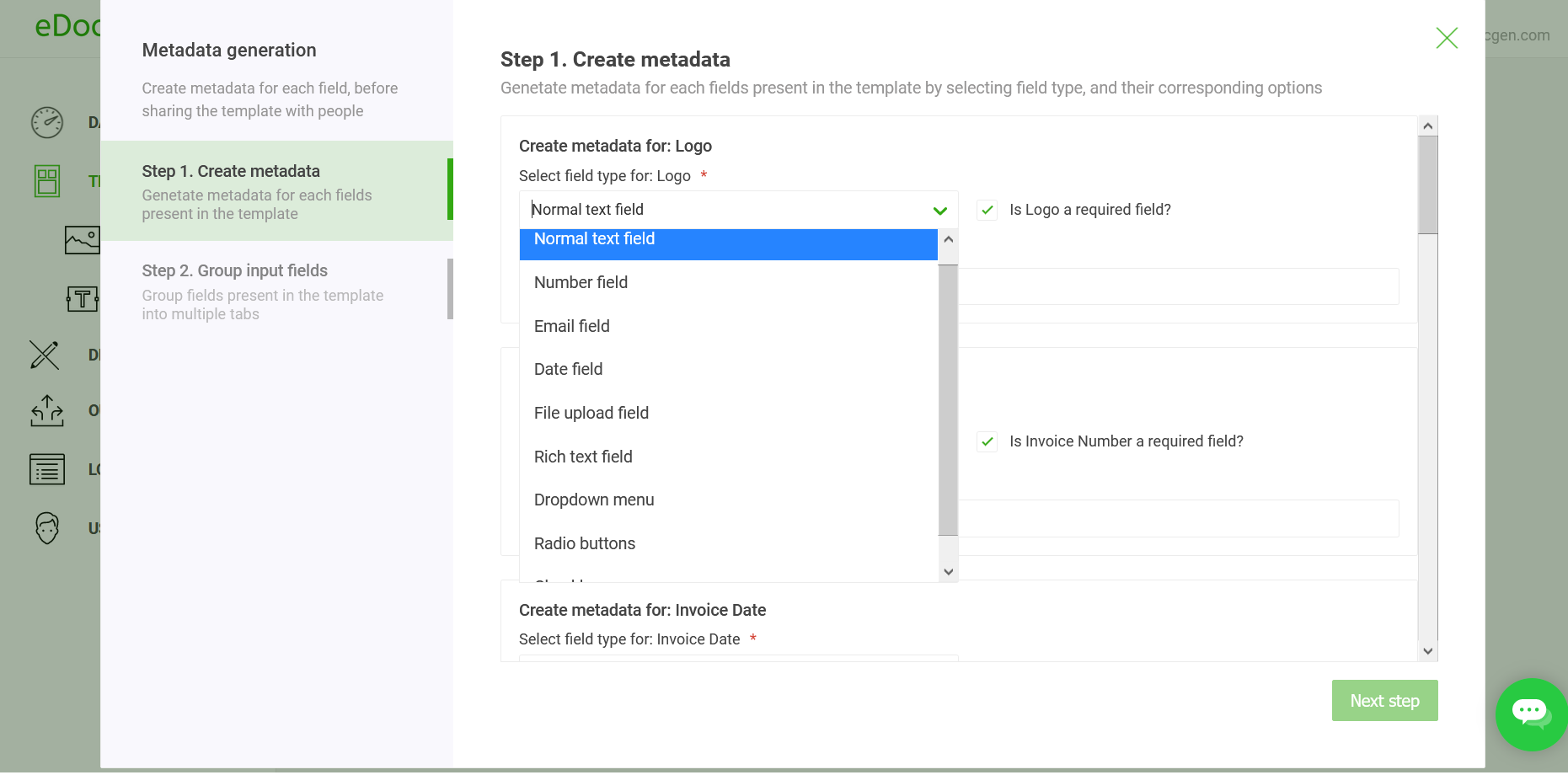

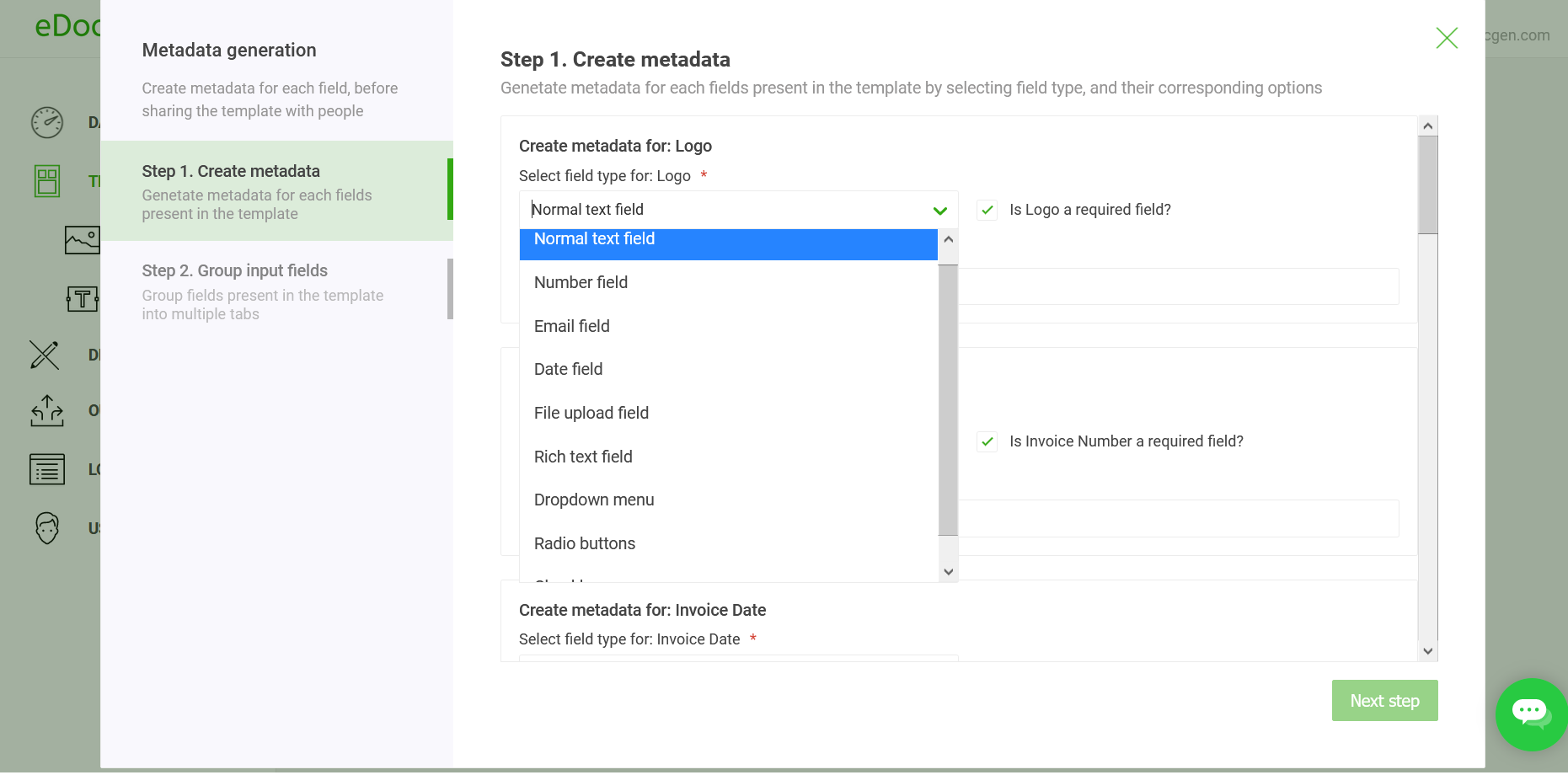

Document automation solution help your remote workforce stay compliant with your policies. To create a new document, users can access the document portal and choose the relevant template. The system will extract data from internal sources and pre-fill certain information. Users can then input the remaining details using a data file or a form. Finally, the system produces the completed document in either Microsoft Word or PDF format.

Thus, insurers can go to market quickly, lower costs, and offer better customer service. They help insurers to beat increased scrutiny from the regulators. They also reduce compliance overheads in the pre-sales phase and save costs.

EDocGen Insurance document automation software

Our Insurance document automation software is built to deliver a powerful, efficient, and streamlined process for generating documents. It is an API-first product that integrates into your IT ecosystem. You can use it for

-

Interactive Document Generation:

Auto-creates data gathering forms (fillable form) from PDF and Microsoft Word templates. The entered information populates the document template, creating a compliant, accurate document. This saves >80% of user's time in insurance documents creation.

-

Bulk (Batch) Document Generation:

It generates thousands of documents from databases and enterprise applications in just minutes, offering omnichannel delivery options such as email, cloud storage, e-signatures, or printing.

-

On-demand document generation:

Interactively create documents for customer/ employee actions such as filling out an inquiry form, workflow actions, or updating customer records.

It enhances brand governance. All documents will be generated using the approved templates from the central repository. This includes creating proposal letters, insurance cards, and policy documents. The most up-to-date document templates and digital assets are always utilized for document generation.

Life Insurance documents

Problem: Crafting personalized policies, complex contracts, and essential compliance documents by hand can be a real drain on resources. This process leaves your team open to mistakes and inconsistencies. Keeping up with branding guidelines, navigating the unique rules of different jurisdictions, and making sure you’re compliant with ever-changing regulations through manual updates isn’t just a hassle – it poses a serious operational risk.

Solution: Picture a system that allows you to whip up highly personalized life insurance documents quickly and accurately at every step. From the initial application forms to the final claims processing and renewal notices, automated document generation guarantees:

-

Rapid Personalization: Create customized policies and contracts that truly reflect each client’s needs and coverage specifics in an instant.

-

Effortless Compliance: Integrate branding guidelines and jurisdiction-specific variations right into your templates. Smart logic automatically adjusts documents to align with the latest regulatory and legal updates, reducing risk and ensuring compliance.

Health Insurance documents

Problem: Health insurance claims processing, pre-authorization workflows and policy document management can be a real headache for your customers. Delays, errors and mixed messages are frustrating—and often damaging—when customers can't get the real-time information they need. That lack of transparency can quickly erode trust and damage customer loyalty.

Solution: Transform your health insurance operations with automated document generation, enabling you to:

-

Turbocharge Claims & Policy Handling: Quickly extract, validate, and route critical claims and policy data, significantly reducing processing times and minimizing errors.

-

Empower Members with Real-Time Access: Provide immediate, on-demand access to vital policy information, real-time claims status updates, and approval notifications, fostering transparency and enhancing member loyalty.

-

Intelligent Workflow Automation: Seamlessly manage the entire claims process, from initial triage to final appeals, using automated workflows that integrate smoothly with your healthcare and CRM systems. This guarantees compliance with regulations like HIPAA at every stage.

-

Proactive Communication: Automatically generate and dispatch personalized, timely updates and notifications to members, keeping them informed and engaged throughout their journey.

Group Insurance documents

Problem: Creating a multitude of group policy documents, detailed contracts and individual member certificates for many beneficiaries can be a real challenge. Manual customization makes it time consuming and increases the risk of inconsistencies and compliance issues.

Solution: Empower your team with document automation to:

-

Generate at Scale, Tailor with Precision: Produce both simple and complex documents, including customized policy documents, detailed contracts and individual certificates for each group and its members.

-

Maintain Unwavering Consistency & Compliance: Mandatory usage of approved templates and sub-templates ensure branding and compliance with jurisdictional requirements. Smart logic adjusts documents to regulatory or legal changes without manual updates.

-

Fortify Compliance & Audit Readiness: Built in audit trails give a clear record of document creation and changes. Automated checks spot potential omissions early so you’re always ready for regulatory reviews and audits.

-

Boost Efficiency & Free Up Your Team: By automating repetitive tasks, you can increase process capacity, reduce cycle times by up to 85% and let your staff focus on strategic initiatives and higher value work, resulting in better accuracy and job satisfaction.

-

Accelerate Onboarding & Renewals: Integrated workflows simplify the entire process, making it smoother and more efficient.

-

Centralized Control & Accessibility: Effortlessly handle a vast array of business templates and additional content through centralized storage and retrieval. This facilitates quick responses to client inquiries and regulatory requests while ensuring your organization is represented with the most up-to-date approved templates.

How EDocGen Insurance Document Automation Software works

Insurance Document Automation Software empowers business users to create/edit templates in familiar Microsoft Word, PowerPoint, Excel, and PDF editors. Thus, users can use existing inusrance templates and edit them in moments without worrying about formatting.

One of the notable features is the ability to make bulk updates to templates whenever there are changes in regulatory content. This is accomplished by dynamically populating content blocks (paragraphs). Rather than having to manually revise each template, you only need to update a single content block, and the new information will automatically appear in all related templates when creating documents.

Additionally, the system allows for the dynamic population of sub-templates, enabling users to incorporate dynamic elements that will be filled in during the document generation process.

|

Templates

|

Authorized users can create, modify, or delete insurance templates. The system supports fillable PDF, Word, Excel, and PPTX templates.

|

|

Dynamic Fields

|

Supports the dynamic population of text, tables, images, content blocks (paragraphs), hyperlinks, charts, QR codes, etc.

|

|

Data Sources

|

Generate documents from Databases, CRM systems, Business applications, XML/JSON/Excel data.

|

|

Additional features

|

Conditional statements (if-else), calculations, and the ability to generate documents in multiple languages.

|

|

Documents

|

Generate Quotes, proposals, policies, claims, and reports in PDF or Microsoft Word format.

|

|

Print/Email/Save

|

Easily print, email, or sync to cloud storage directly from the output folder.

|

|

Archiving

|

Archive generated documents to document management systems such as SharePoint.

|

Insurers can generate professional, print-ready documents in DOCX, PDF, XLSX, PPTX formats instantly. Below diagram depicts how the system generates documents from structured data.

The system allows you to create documents from various databases, including Oracle, SQL Server, MySQL, and CRMs like Salesforce and Dynamics 365. Additionally, you can generate documents from multiple data sources within a single cycle of insurance document generation.

A big bottleneck in the insurance process is document collection. Many insurance companies still turn to email for requesting and collecting documents from customers to complete onboarding. This wastes productivity.

Using the system, insurers can auto-generate fillable forms from existing insurance templates. Customers can access these forms online through secure URLs. They can fill out, e-sign, and upload supporting documents through these forms. The system populates the form data into the templates and embeds the uploaded documents to generate onboarding document packages. This increases processing capacity and improves customer experience.

The system automatically fills document templates with the latest data from your CRM, making it easy to generate and send personalized customer communications. Whenever a customer interacts with your portal, the system can instantly trigger and deliver the right documents at the right time. This ensures every insurance document is tailored to the individual and always reflects the most current information, streamlining the entire communication process.

EDocGen is built for complex Insurance document management needs. With a well-developed REST API, it integrates into your eco-system seamlessly to fill gaps in your core system. It is HIPAA compliant.

Using insurance document automation software significantly reduces risk, and improves compliance governance. It also enhances the customer experience apart from cost and time savings.

EDocGen vs In-House System

While the thought of creating your own document generation system might sound tempting, EDocGen brings a lot to the table that often makes it a better choice than a homegrown solution.

-

Faster Time-to-Value: It is a ready-to-deploy, powerful platform equipped with pre-built connectors and user-friendly interfaces. On the other hand, building an in-house system can take a lot of time, resources, and ongoing maintenance, which can slow down the benefits you’re hoping to achieve.

-

Lower Total Cost of Ownership (TCO): Think about all the expenses tied to developing, testing, deploying, maintaining, upgrading, and hiring specialized IT staff for an in-house solution. EDocGen offers a straightforward subscription model that usually leads to lower overall costs and minimizes the risk of going over budget.

-

Scalability and Flexibility: It is designed to scale with your business needs. As your document volume and complexity grow, the platform can easily handle the increased demands. In-house systems may require significant re-architecting and upgrades to accommodate growth.

-

Industry Expertise and Best Practices: It is specifically built with the needs of regulated industries like insurance in mind. We understand the unique challenges you face and incorporate industry best practices into our platform. An in-house team may lack this specialized knowledge.

-

Continuous Innovation and Support: It is constantly evolving with new features, integrations, and security updates. Our dedicated support team ensures you have access to expertise and assistance whenever you need it. In-house systems rely on your internal IT resources for ongoing development and support.

-

Focus on Core Business: Building and maintaining a document generation system is not your core competency. By choosing EDocGen, you can focus your valuable resources on your primary business objectives – underwriting, risk management, and serving your customers.

-

Integration Ecosystem: It boasts a strong ecosystem of integrations with various CRM, policy administration, claims management, and other essential insurance systems, ensuring seamless data flow and eliminating silos. Building and maintaining these integrations in-house can be complex and time-consuming.