In the mortgage world, document automation isn’t just a fancy buzzword. It's the engine that's turning a notoriously slow, paper-choked process into a fast, accurate, and digital workflow. At its core, automation uses tech like AI, OCR, and NLP to digitize, pull data from, and process loan documents without someone having to manually eyeball every single page. The result? Approval times that are drastically shorter.

Let's be honest, the days of towering stacks of paperwork and endless manual reviews are numbered. The mortgage industry has shifted to intelligent workflows where technology handles the heavy lifting—things like document verification, data extraction, and compliance checks. This isn't some far-off concept; it’s what competitive lenders are doing right now to stay ahead.

This evolution is changing how we operate. By end of 2026, it’s expected that AI-driven automation will be a standard part of mortgage underwriting. Think about it: where manual handling once led to constant human errors and painful delays, technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP) now let lenders pull, check, and validate borrower data in mere seconds.

Before we get into the tech, let's look at the real-world impact. The difference between the old way and the new way is night and day. Automation brings clear wins in speed, cost, and accuracy, making a powerful argument for leaving manual processes behind.

Here’s a quick breakdown of what that looks like in practice.

|

Metric |

Manual Processing (Traditional) |

Automated Processing (Modern) |

|

Loan Processing Time |

30-45 Days |

2-7 Days |

|

Document Indexing |

Hours |

Minutes |

|

Data Entry Error Rate |

3-5% |

<0.5% |

|

Operational Cost |

High (Labor-intensive) |

Low (Reduced manual effort) |

|

Compliance Risk |

High (Human oversight) |

Low (Systematic checks) |

As you can see, the numbers speak for themselves. The move to automation isn't just about efficiency; it's about transforming the entire operational model.

Of course, when you modernize workflows dealing with sensitive financial data, protection is key. Always do your homework on the security of online document platforms to ensure you're keeping borrower information safe.

So, how does all this work? Two key pieces of technology are at the heart of the change, and they work together to make mortgage document automation a reality.

Adopting automation is no longer just about getting ahead; it's about keeping up. Lenders sticking with manual processes are facing higher costs, bigger compliance risks, and a clunky customer experience that will put them at a serious competitive disadvantage.

This powerful duo of OCR and NLP takes the tedious, error-prone work of manual data entry off your team's plate. Instead of a loan officer spending hours poring over documents to cross-reference details, an automated system can do the same checks with better accuracy in a fraction of the time. This frees up your people to focus on what matters most: handling complex loan scenarios and building strong relationships with clients.

Here's a hard-won lesson from the field: successful mortgage banking document automation doesn't start with the new software. It begins with a clear-eyed look at your existing infrastructure. Before you even think about integrating a platform like EDocGen , a bit of groundwork is critical for a smooth, headache-free rollout.

The first move is always a frank assessment of your current systems. Your most critical data—the lifeblood of your operation—probably lives in a Loan Origination System (LOS), a Customer Relationship Management (CRM) platform, or even a tangled web of complex spreadsheets. These are the goldmines of information that your new automation tool will tap into.

You need to get specific and pinpoint exactly where key borrower information is stored. Is your LOS the single source of truth for everything, or does your processing team rely on a separate system for underwriting conditions? Documenting these data flows isn't just a nice-to-have; it's non-negotiable.

To head this off, map out your primary data sources for a typical loan file:

Once you know where all the data lives, the integration plan starts to take shape.

A critical mistake is underestimating the rigidity of legacy systems. I've seen projects get stuck for months because a team assumed their older platform had a modern API. Some have limited or poorly documented APIs, making data extraction a nightmare. Get your IT team to investigate this upfront to prevent major delays.

This brings us to the next practical step: clarifying API access. Your IT team needs to confirm that your core systems can actually "talk" to an external platform like EDocGen. This means checking for available REST APIs that allow for a secure, real-time exchange of data.

Without this technical bridge, you’re stuck with manual data exports and uploads. And that just reintroduces the very friction and risk you're trying to eliminate.

By tackling these operational and technical prerequisites first, you're laying a solid foundation. This prep work ensures your mortgage banking document automation project starts on the right foot, paving the way for a much faster and more successful implementation.

This is where you move past basic mail-merge and unlock the real power of mortgage banking document automation . A smart template isn’t just a digital form—it's the intelligent engine that powers your entire workflow. These templates are dynamic, responsive, and deeply connected to your core systems.

Think of it like creating a blueprint for accuracy and speed. You start with a critical document, maybe a Loan Estimate. But instead of leaving blank spaces for someone to fill in manually, you insert dynamic fields . These are essentially placeholders that automatically pull data directly from your Loan Origination System (LOS) or CRM. Borrower names, loan amounts, and property details flow right into the document without a single keystroke.

The real game-changer is conditional logic . This is what allows the template to essentially think for itself. For example, you can set up a rule that automatically includes specific legal clauses required for an FHA loan but leaves them out for a conventional one. The system simply checks the loan type in your data source and adjusts the document on the fly. No more manual review to see which clauses apply.

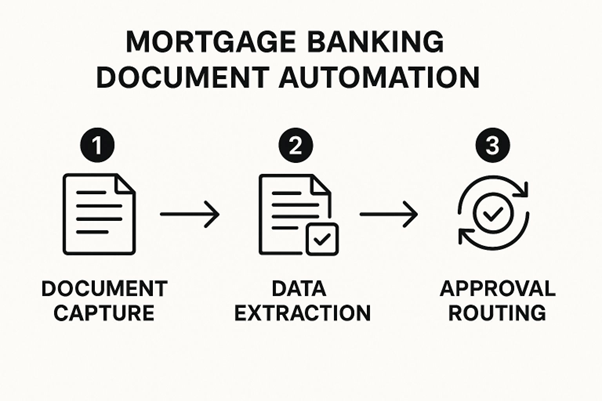

This visual shows a simplified flow of how data moves through an automated system, highlighting the efficiency at each step.

As you can see, it’s a clear progression from data capture to final approval, with automation streamlining every stage of the process.

Another area where this shines is with complex formatting, like tables for amortization schedules or fee summaries. A smart template can generate these tables dynamically, adding or removing rows based on the loan's specific details. Every calculation is perfect, every time.

A common mistake I see is teams trying to build one giant, monster template to handle every possible loan scenario. It’s far more effective to create several specialized templates for major loan types (Conventional, FHA, VA). This approach is much easier to manage, test, and update, which significantly cuts down the risk of errors.

This level of granular control is what makes mortgage banking document automation so valuable. In fact, some reports show this can slash document processing times by a staggering 80% . This doesn't just speed up the loan cycle; it also strengthens compliance by taking the risk of human error out of the equation.

Let's look at how this works in the real world with a platform like EDocGen. You can manage all your templates from a clean, central repository.

This kind of centralized hub is crucial for brand governance and ensures your teams are always using the correct, most up-to-date versions of every document.

Right inside the EDocGen editor, a loan ops manager—with zero coding experience—can do some powerful things:

By building intelligent templates, you're not just digitizing paper—you're creating a reliable, scalable system that guarantees accuracy and compliance. If you want to explore these capabilities further, you might find our guide on financial document automation helpful. This is truly the foundation of an efficient modern mortgage operation.

Let's be honest: your document automation platform is only as good as the data you feed it. Real, game-changing efficiency in mortgage banking document automation doesn't come from the tool itself, but from how deeply it's woven into your core systems. You need a seamless, real-time connection between your generation tool and the software your team lives in every day. This is the digital bridge that finally gets rid of manual data entry for good.

The whole point is to map data fields directly from your Loan Origination System (LOS) or CRM to the dynamic placeholders in your smart templates. When a loan officer updates a borrower's income or changes their loan status, that new information should instantly and accurately populate every single related document. No re-keying. No fat-finger typos. No sending out a pre-approval with last week's numbers.

So, how do you build this bridge? The main tool for the job is a REST API . If you're not a developer, just think of an API as a secure messenger that lets different software systems talk to each other. Your tech team will use the API from your document automation platform to "call" for specific data points from your LOS the moment a document is needed.

Here’s a practical example: A loan officer clicks "Pre-Approved" in your LOS. This action can be set up to trigger an API call to your document platform. In a split second, the system grabs all the necessary borrower data, generates a personalized pre-approval letter, and can even email it out automatically. No one has to lift a finger.

This on-demand capability is what separates modern automation from the clunky, batch-based processes of the past. It means your document creation happens in lockstep with your actual workflow milestones.

An API integration is more than just a technical to-do list item; it's a strategic move that aligns your data with your operations. I've seen poorly planned integrations create more headaches than they solve, leading to data mismatches and broken workflows. Make sure your business and IT teams are in the same room, mapping out every single data point and trigger event before a line of code is written.

As you start hooking everything together, it's crucial to find the right balance between technology and the human touch. The most effective mortgage operations I've seen embrace a hybrid model. Automation handles the high-volume, repetitive tasks with machine precision, which frees up your experts for the work that actually requires their brainpower.

Think about underwriting. AI-driven tools can perfect the accuracy of income calculations and asset verification by reviewing documents automatically, letting human underwriters focus on the tricky, non-standard loan files that require critical judgment. This synergy is key, especially for maintaining compliance and navigating complex loan scenarios.

To make this hybrid model work, you need a powerful and flexible platform at the center of it all. By streamlining banking automation , you're not just making things faster. You're building that essential data bridge that empowers your team to work smarter and perform at a much higher level, turning your investment into a genuine competitive edge.

While generating a single, accurate document is a good start, the real magic of mortgage banking document automation happens when you scale up. It's one thing to create one perfect Closing Disclosure; it's another thing entirely to generate thousands of compliant, personalized documents with a single click.

This is where your team shifts from putting out fires to proactively managing high-volume output. The efficiency gains become too big to ignore.

Think about year-end escrow analysis statements. For most lenders, this is a massive, multi-week headache riddled with potential for costly mistakes. With automation, that frantic scramble turns into a streamlined workflow that you can knock out in minutes.

The entire process hinges on your data. Instead of pulling up individual loan files one by one, all you need is a single, structured data source. This is usually a simple CSV file exported from your Loan Origination System (LOS) or another core database.

Each row in that file represents a unique loan, and each column holds the specific data points your document needs. Things like:

Once you have this data file, you just upload it into an automation platform like EDocGen . The system then rips through each row, populating your smart escrow template with the correct data. In minutes, it spits out thousands of completed, personalized, and perfectly calculated statements.

The real beauty here is its simplicity and repeatability. You're not just saving time; you're building a reliable, auditable workflow. This is a game-changer for reducing compliance risk, especially for high-stakes documents like year-end statements where accuracy and timeliness are non-negotiable.

Generation is only half the battle. A truly effective mortgage banking document automation strategy has to handle distribution with the same hands-off efficiency. After all, what good are thousands of perfect documents if they’re just sitting in a folder, waiting for someone to manually email them out?

This is where automated distribution workflows come in. You can set up rules that trigger based on specific events, sending documents to all the right stakeholders at once. No more delays, no more communication gaps.

Let's take a final Closing Disclosure as an example. A single trigger—like a loan officer marking the file "final approval" in your LOS—can kick off a whole sequence of events.

|

Recipient |

Delivery Method |

Action Triggered |

|

Borrower |

Secure Email with e-Sign |

Instantly sends the document for required signatures. |

|

Title Agent |

Secure Portal Upload |

Automatically uploads the final CD to their shared workspace. |

|

Real Estate Agent |

Standard Email |

Sends a watermarked, non-editable copy for their records. |

|

Internal Archive |

Cloud Storage (S3) |

Files an executed copy into a designated compliance folder. |

This kind of simultaneous, multi-channel distribution shaves hours off every single loan closing. When you master both bulk generation and automated distribution, you're not just improving a task. You're fundamentally transforming a series of tedious manual steps into a single, powerful, and scalable workflow that fuels your business growth.

This is, without a doubt, the first and most important question. And it should be. The good news is that any reputable platform is built with bank-grade security from the ground up. You're looking for vendors who can point to specific, robust measures like end-to-end AES-256 encryption . This standard ensures data is scrambled and unreadable, both when it's moving between systems and when it's sitting on a server.

Beyond encryption, ask for their credentials. A SOC 2 Type II certification is a big one. It's not just a snapshot; it's an independent audit proving the provider maintains strict controls for managing and protecting your data over a period of time. Always dig into a vendor’s security and data handling policies before you commit to anything.

No single tool can magically "guarantee" compliance—that ultimately falls on the lender. However, automation is an incredibly powerful ally in enforcing it. Think about where the biggest compliance risks lie: human error. A forgotten disclosure, a fat-fingered number on a Loan Estimate... these simple mistakes can lead to serious penalties.

This is where automation shines. By building your process around smart templates with pre-approved legal language and conditional logic, you hardwire the rules directly into your workflow. The system doesn't forget. It automatically pulls the right disclosures for a specific loan type and runs the calculations for TRID perfectly, every single time. You end up with a consistent, auditable trail that regulators love to see. For a deeper look at this, you can explore how to build out a complete document workflow automation strategy that reinforces these critical checks.

Automation transforms compliance from a manual checklist item into a systematic, built-in function of your workflow. It moves the goal from hoping for compliance to engineering it.

That's a very common misconception. A document automation platform doesn't replace your Loan Origination System (LOS)—it enhances it . The best way to think about it is as a specialized, high-performance engine that you bolt onto your existing system.

Ready to eliminate manual errors and accelerate your closing times? EDocGen provides a powerful, secure platform for mortgage banking document automation that integrates seamlessly with your existing systems.