Imagine a bank's workflow is like a city's traffic system. When it’s working well, everything flows smoothly. But manual processes? They’re the rush-hour gridlock. This is the reality for banks still wrestling with traditional document management, where simple tasks like data entry and compliance checks create costly bottlenecks and open the door to serious risks.

Banking financial document automation is the modern infrastructure built to clear these jams for good.

For a lot of financial institutions, handling documents by hand is just the way things have always been done. But this reliance on old-school methods comes with substantial, often invisible, costs that quietly drain resources and hold back growth. Every loan application, compliance report, and customer onboarding form processed by a person represents a real cost in time and money.

The sheer volume of paperwork can be staggering. Teams spend countless hours on mind-numbing tasks like keying in data, double-checking information, and physically shuffling files from one desk to another for approval. This doesn't just slow down critical processes; it pulls your most skilled people away from strategic work that actually moves the needle.

At its core, banking financial document automation is about teaching computers to handle the relentless flow of paperwork and digital files that keeps the financial industry moving. Think of it as hiring a team of digital assistants who work 24/7 with near-perfect accuracy. They don’t just shuffle files—they read, understand, and act on the information inside them.

This technology isn't a single piece of software; it's an integrated system of smart tools designed to turn manual chores into smooth, automated workflows. It manages a document's entire lifecycle, from the moment it arrives until it's securely archived.

Instead of a loan officer spending hours manually keying in data from a PDF application into the core banking system, an automation platform gets it done in a flash. This simple shift frees up your team from monotonous data entry, letting them focus on high-value work like analysis and customer engagement.

To really get what's happening under the hood, it helps to understand the key technologies that drive the process. These parts work together like a well-oiled assembly line, with each one performing a specific task to move a document along without anyone needing to lift a finger.

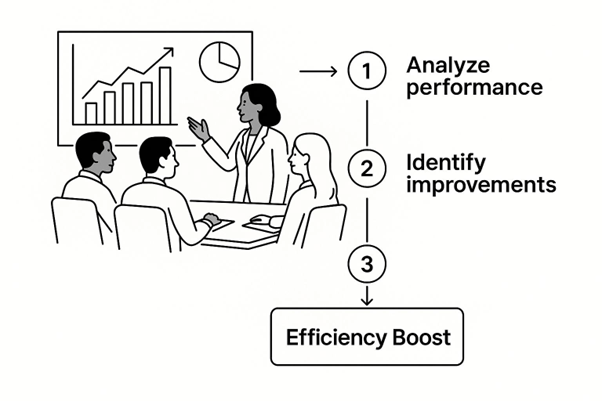

This infographic gives you a great visual of how these elements come together to boost efficiency across the board.

As you can see, a connected, automated process gets rid of the constant stop-and-start of manual work, creating a smooth and efficient information highway.

Let's walk through a common scenario: processing a mortgage application. Done the old way, this can take days, sometimes even weeks. An employee gets the application, physically reviews it, enters the data into multiple systems, checks for errors, and then finally hands the file off to an underwriter. It’s slow and ripe for human error.

With banking financial document automation , that journey looks completely different.

What was once a multi-day, error-prone headache becomes a streamlined process that can be wrapped up in minutes. That’s the practical power of document automation in action. To see how the sausage is made, you can explore more about the financial document automation solutions that drive this kind of change.

The goal of automation isn’t to replace human expertise—it’s to supercharge it. By taking over the repetitive tasks, the technology empowers financial professionals to make faster, smarter decisions with accurate, instantly available data.

The impact here is massive. Recent data shows that financial institutions are increasingly adopting AI-driven automation. This shift has helped banks slash human errors in document processing by as much as 98% , while also cutting operating costs and boosting productivity by over 50% .

It’s one thing to understand how banking financial document automation works on a technical level. It’s another thing entirely to grasp just how profoundly it can sharpen a financial institution’s competitive edge. This isn't about small, incremental tweaks; it’s a fundamental shift in how a bank operates.

When you bring in automation, you’re making the entire organization more agile, more secure, and far more responsive to what customers actually need. The benefits ripple out from the back office to the front lines, fueling efficiency, cutting costs, tightening compliance, and creating a genuinely better customer journey.

Think about the classic loan approval process. It’s a marathon of paperwork, manual checks, and endless back-and-forth that can easily stretch on for weeks. That frustrating delay doesn't just test a customer’s patience—it ties up your best people in low-value work.

Automation turns that marathon into a sprint.

Once a loan application is submitted, an automated system can instantly pull and validate all the data, check it against internal records, and have it ready for an underwriter in minutes. What once took weeks can now be wrapped up in a few hours, sometimes even faster.

By stamping out manual bottlenecks, automation doesn’t just speed things up. It frees your talented team to focus on what humans do best: exercising judgment, performing strategic analysis, and building stronger relationships with customers.

And this isn't just about lending. Account openings, compliance reviews, and trade finance documents all get the same massive speed boost, improving performance across the board.

In the heavily regulated world of finance, compliance isn’t just a box to tick—it’s the bedrock of the business. Relying on manual document management is a huge liability. It makes maintaining a clean audit trail nearly impossible and turns regulatory inquiries into a frantic scramble.

Automation bakes compliance right into your daily workflows. Every single action taken on a document is logged automatically, creating a crystal-clear, unchangeable audit trail. Prepping for an audit becomes as simple as running a report, not an all-hands-on-deck file hunt.

For fintechs especially, solid compliance process automation can be a major competitive advantage. By standardizing how documents are handled, you ensure every file follows the exact same rules, drastically cutting the risk of human error and non-compliance penalties.

A few key compliance wins include:

All these efficiency and compliance perks translate directly into serious cost savings. When you stop relying on people for repetitive tasks, operational overhead plummets. In fact, research shows automation can slash the time spent on routine manual work by 30-40% , which hits the payroll line directly.

Fewer mistakes also mean fewer expensive fixes. A single miskeyed digit can lead to financial errors, regulatory fines, or customer disputes—all of which cost a fortune to untangle. Automation minimizes these risks, protecting your bottom line.

As you can see, banking financial document automation delivers a powerful return on investment by optimizing workflows and eliminating hidden costs. This lets financial institutions pour those saved resources back into innovation and growth, securing a real competitive advantage in a tough market.

One of the first technical questions that comes up is how to get a modern automation platform to play nicely with older, core banking systems. These legacy platforms are critical, but they were built long before today's cloud-based tools were even a concept. Trying to force a direct connection can feel like a monumental task.

But here’s the good news: you don’t need to rip and replace your core infrastructure. The smart move is to find an automation platform that offers flexible Application Programming Interfaces (APIs). Think of APIs as a universal translator, letting your new and old systems swap data securely and smoothly.

A phased rollout is also your best friend here. Don't try to boil the ocean. Start by automating one high-impact process, like customer onboarding or invoice processing. This lets you prove the concept, iron out any wrinkles, and build some internal buzz before you go bigger.

In banking, data security is everything. Period. Bringing in any new system that touches sensitive customer information is going to raise red flags around security and compliance. Your automation solution has to meet the industry's iron-clad standards from day one.

Zero in on platforms built with bank-grade security at their core. This means non-negotiable features like end-to-end encryption, detailed access controls based on user roles, and complete, unchangeable audit trails. These tools don't just protect your data—they make it far easier to prove compliance when the regulators come knocking.

By making a solution with tough security protocols a top priority, you ensure your banking financial document automation project actually strengthens your security posture instead of weakening it. This turns a potential roadblock into a real strategic advantage.

Rolling out banking financial document automation isn't a single, giant leap; it's a well-planned journey. To get it right, you need a clear, strategic roadmap that takes you from an initial assessment all the way to ongoing improvements. By breaking the process down into manageable stages, you can navigate the transition with confidence, keep disruptions to a minimum, and unlock the full value of your investment.

This blueprint lays out a proven five-stage framework that will guide your organization from concept to full-scale deployment. Following these steps helps build momentum, show value quickly, and make sure your automation initiative becomes a lasting strategic asset.

Before you can automate anything, you have to know where you're starting from. Begin by mapping out your existing document-heavy processes. Which workflows are causing the most friction? Where are the bottlenecks that slow down customer service or gum up internal operations?

Look for areas that are crying out for help:

Nailing down these high-impact areas lets you prioritize your efforts. When you focus on the processes with the biggest potential for a quick win, you build a rock-solid business case for wider adoption. This initial analysis is the bedrock of your entire rollout.

Once you know what you need to fix, it’s time to choose the right tool for the job. Not all automation platforms are built the same, especially when you factor in the specific demands of the financial world. The right partner will offer a solution that is secure, scalable, and plays nicely with the systems you already have.

When you're vetting vendors, keep an eye out for these key capabilities:

For a deeper look at what a top-tier solution brings to the table, exploring tools designed specifically for banking automation can give you a better feel for the features that matter most.

With a partner on board, fight the urge to automate everything at once. A focused pilot program is the smartest way to get started. Pick one of those high-impact workflows you identified in stage one—something like invoice processing or customer onboarding—and launch a small-scale, controlled test.

A pilot program is your proof of concept. It lets you demonstrate real results fast, iron out any wrinkles in a low-risk setting, and get people inside the company excited about the project.

This approach gives you hard data on ROI, efficiency gains, and error reduction. A successful pilot creates a buzz and makes it much easier to get the buy-in you need from stakeholders for the next phase.

After a successful pilot, you're ready to start scaling the solution across the organization. The trick is to do it in deliberate, manageable phases. Take the lessons you learned from the pilot and use them to shape your broader implementation strategy.

Start by rolling out the automation to the rest of the team in the initial department before moving on to other business units. This phased approach keeps your teams from feeling overwhelmed and ensures everyone gets the right training and support to adapt to the new way of working. It’s a methodical expansion that guarantees a smoother, more sustainable transition.

Finally, remember that banking financial document automation isn't a "set it and forget it" deal. Your business needs will change, and your automation platform has to keep up. You need a system for continuous monitoring and optimization.

Regularly review key performance indicators (KPIs) like processing times, error rates, and operational costs. Get feedback from the people actually using the system to spot opportunities for making things even better. This ongoing cycle of improvement ensures your automation system stays a powerful tool that adapts to new challenges and keeps delivering maximum value for the long haul.

It’s one thing to talk about the theory of automation, but making it happen on the ground is a different story. The right technology partner is what bridges that gap, turning the promise of banking financial document automation into something you can actually use. That's where a platform like EDocGen comes in. It’s built specifically to handle the tricky document challenges that are unique to the financial world, hitting all the big pain points like security, compliance, and speed.

Instead of trying to be a one-size-fits-all tool, EDocGen offers a specialized kit. Its secure document generation is designed for the high-stakes environment of banking, where every single loan agreement, account statement, or compliance report has to be perfect. The platform plugs right into core banking systems, pulling customer data automatically to fill out templates with pinpoint accuracy.

One of its smartest features is the use of advanced conditional logic. This lets banks create dynamic templates that change based on a customer’s profile or the product they’re getting. Think about it: a single mortgage template can automatically add or remove certain clauses depending on the applicant's state, credit score, or loan type.

This means every document that gets created is not only personalized but 100% compliant with the rules that apply to that specific situation. The risk of someone grabbing the wrong template or forgetting a key detail? Gone.

The user-friendly interface is another huge win, as you can see below.

This shows how regular business users—not just developers—can build and manage complex document workflows. That massively cuts down the reliance on IT for everyday changes and updates.

Giving this power to the teams on the front lines is a game-changer in a fast-moving market. The demand for intelligent document processing (IDP) is exploding, and the banking and financial services industry is leading the charge. In fact, the BFSI sector accounts for around 30% of all global spending on IDP.

EDocGen effectively shifts document creation from a slow, administrative chore into a fast, automated, and strategic part of the business. It lets your team stop being document creators and start being process managers.

At the end of the day, EDocGen is the engine that drives true banking financial document automation . It speeds up everything from onboarding new customers to packaging complex loans, all while cutting down on manual work, boosting accuracy, and getting you to revenue faster. For any modern bank, that’s not just an upgrade—it's a serious competitive edge.

In banking, security isn't just a feature; it's the foundation of everything. Modern automation platforms are built from the ground up with this in mind. Think bank-grade security protocols, including end-to-end data encryption that protects sensitive information whether it's being worked on or sitting in an archive. From the moment data is entered to the second it's stored, it's locked down.

On top of that, these systems give you incredibly granular access controls . You decide exactly who can see, edit, or approve certain documents—down to the individual user. Combine that with comprehensive audit trails that log every single action, and you have a completely transparent and traceable record. In many ways, this makes automated systems even more secure than old-school manual processes, which are vulnerable to human error and have almost no real-time visibility. This kind of robust framework is exactly what you need to meet strict compliance standards like GDPR and CCPA.

Absolutely. It’s a common misconception that automation is only for simple, fill-in-the-blank forms. Early tech might have been that limited, but today’s systems are in a different league entirely.

Modern platforms use something called Intelligent Document Processing (IDP) . This is a powerful combination of OCR (Optical Character Recognition) and artificial intelligence that doesn't just read text—it truly understands it. This means it can make sense of complex, unstructured documents like legal contracts, multi-page invoices, and detailed customer correspondence without needing a rigid template.

The software is smart enough to identify and pull out key information, like specific clauses in a contract, line items on an invoice, or critical dates in a letter, no matter how the document is laid out. It can even flag when something looks off or is missing and send it over for a human to review. This is what makes current banking financial document automation a perfect fit for the incredibly diverse paperwork that banks juggle every day. To get a better feel for the technology behind it, you can explore the different types of document automation software on the market today.

Ready to eliminate manual document bottlenecks and accelerate your workflows? EDocGen provides a secure, scalable platform designed for the unique demands of the financial industry. .