Anyone who's worked in a commercial lending department knows the feeling manual loan documentation. Loan officers are buried in documents, manually keying in data, and chasing down signatures. It’s a recipe for costly mistakes and agonizingly slow approvals that leave everyone—from the borrower to the C-suite—frustrated.

The truth is, the industry is finally moving on from this outdated model. It has to. The pressures of complex regulations and customer expectations for digital speed are just too great to ignore.

This newfound speed isn't a small tweak—it's a serious competitive edge. Closing more deals faster means bringing in more revenue and capturing more market share. Your loan officers are freed from the mundane tasks, letting them focus on what they do best: building client relationships and originating new business.

Think about it. A single commercial loan can easily involve dozens of documents, from the initial application and financial statements to appraisals, environmental reports, and complex legal agreements. Juggling all of this by hand isn't just slow; it's practically an invitation for human error. One misplaced decimal, an outdated form, or a missed signature can completely derail a deal or, even worse, expose the institution to serious compliance risks.

Today's market is all about speed and precision. Lenders still clinging to manual processes report that up to 20-30% of their team's time is lost to low-value administrative work—chasing down paper, correcting typos, and re-keying data. That’s time not spent on what actually matters: building client relationships and performing sharp risk analysis.

This is precisely where commercial loan document software steps in. It functions as a digital command centre for the entire lending process.

If you dig a little deeper, you'll find a few powerful forces accelerating this shift away from paper-based lending.

As the industry continues its digital evolution, understanding the evolving role of FinTechs in business lending provides critical context. This technology isn't just an IT upgrade; it's a fundamental reinvention of how lending gets done, creating the digital backbone that will support a more secure, efficient, and profitable future.

It’s a common misconception to see this software as just a fancier version of cloud storage. In reality, storage is just a tiny piece of what it does. The real magic comes from its ability to actively manage how documents are created and how they flow through your organization.

By connecting different stages and teams, it creates a single, reliable source of truth for every loan. This puts an end to the dangerous game of "version control," where multiple copies of a document are floating around and nobody is quite sure which one is the final version. In fact, studies show productivity can jump by 20% to 60% .

The core job of commercial loan document software is to take a fragmented, manual process and turn it into a cohesive, automated workflow. It’s about building a system that stops errors before they happen, not just catching them later.

For instance, when a loan officer needs to assemble a new loan package, they don't start from a blank page. They use an intelligent template that automatically pulls in the right borrower data, includes the correct clauses for that specific loan type and jurisdiction, and makes sure all the required fields are filled out.

Let's follow a document's journey to see how this works in the real world.

This systematic approach is what makes the difference. If you're interested in the nitty-gritty, you can learn more about the capabilities of modern loan documentation software and see how it handles each of these stages. Ultimately, this technology lets your team shift its focus from tedious paperwork to high-value work like risk analysis and building client relationships.

The nightmare of version control is a huge source of anxiety in lending. We've all been there—multiple drafts of a document flying around in emails. It's dangerously easy to work from an outdated version, which can lead to serious contractual mistakes.

A centralized repository solves this by creating a single source of truth. Every document for a specific loan lives in one secure, accessible place.

This simple, clear organization wipes out ambiguity and drastically cuts the risk of using bad information.

The first step in modernizing lending is to get rid of the manual, error-prone drudgery of building loan packages. This is where dynamic document generation comes in. Instead of the risky habit of copying and pasting from old templates, the software uses intelligent, living templates.

These templates automatically pull verified data straight from your core banking system or CRM. This means the borrower's name, loan amount, and property details are right every single time. The software also uses conditional logic to insert the correct legal clauses based on the loan type, collateral, and jurisdiction, piecing together a compliant, customized document package in minutes, not hours.

Historically, the final steps of closing a loan have been the biggest time-suck, requiring everyone to physically be in the same room for wet-ink signatures. Integrated e-signature capabilities completely change the game, turning this final hurdle into a smooth digital experience. Borrowers can securely sign documents from anywhere, on any device they own.

This does more than just slash closing times from weeks to days; it creates a far better experience for the borrower. The software walks signers through the package, making sure no signature fields are missed and that the final, executed documents are instantly and securely filed back in the centralized repository.

For any compliance officer, preparing for an audit can feel like a monumental task of digging through mountains of paper and endless email chains. Commercial loan document software transforms this headache into a simple report-generating exercise.

The platform automatically creates a detailed audit trail that logs every single action taken on a document—from creation to close. It can even run automated checks to ensure all required documents are present and all necessary fields are filled out before a loan can move forward, building compliance right into the daily workflow.

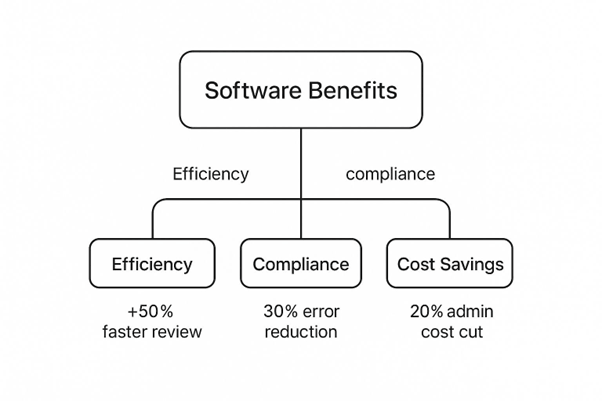

This infographic shows exactly how these features lead to real benefits like better efficiency, fewer compliance errors, and major cost savings.

The impact is clear. Lenders are reporting more than 50% faster review times and a 30% reduction in compliance-related mistakes. These kinds of results are driving a massive industry shift, with the global commercial loan software market expected to reach $16.9 billion by 2034. This explosive growth is being fueled by AI and strategic partnerships—like the one between Numerated and GoDocs—which integrate automated document solutions to make loan preparation and execution even faster.

This move toward automation isn't just an internal trend; it's part of a huge market shift. The global commercial loan software market was valued at around USD 7.6 billion and is expected to grow at a CAGR of 9.7% through 2034. This growth is fueled by ever-increasing regulatory demands and the need for flexible solutions to manage complex financial products with greater accuracy.

If you think commercial lending tech has come a long way, just wait. The evolution isn’t just continuing—it’s picking up speed. The commercial loan document software we have today is more than just a tool to get things done faster. It’s the groundwork for a much smarter, more automated world of finance. The next wave isn't about incremental improvements; it's about making documents active, intelligent participants in the lending process.

This shift is happening right now, fueled by big leaps in artificial intelligence and other game-changing technologies. And the market is all-in. The global commercial loan servicing software market, currently valued around USD 6.96 billion , is on track to nearly double, hitting USD 13.86 billion by 2032. This isn’t just hype; it reflects a real hunger in the industry for smarter solutions.

Picture your legal team having a digital co-pilot—an expert assistant that never gets tired. That's what AI-powered document analysis is bringing to the table. Soon, the best commercial loan document software won’t just generate contracts; it will review them with a level of detail that even a seasoned expert would find hard to match.

Using natural language processing, these systems will be able to:

This isn’t about replacing your legal eagles. It’s about augmenting them. It frees them from the grunt work of manual contract review so they can focus on high-stakes strategy and negotiation. The AI handles the exhaustive first pass, making sure nothing slips through the cracks.

The real destination here is what we call 'intelligent documents.' These are files that are essentially self-aware. They understand their own content, can audit themselves for compliance, and even trigger the next steps in a workflow—like sending a notification—once a signature is added or a key date passes.

Another technology set to completely redefine loan documentation is blockchain. It gets a lot of press for cryptocurrency, but its true power in lending lies in its ability to create an unchangeable, transparent, and rock-solid record of every transaction.

Think of it like this: in a blockchain-based system, every single step in the loan’s life—from origination and signing to servicing and the final payoff—is recorded as a "block" in a shared digital ledger. Once that block is added to the chain, it can't be altered or deleted. Ever.

This gives us a few massive advantages:

Getting on board with today's advanced commercial loan document software is the critical first step. By digitizing and structuring your document workflows now, you're not just improving efficiency—you're building the launchpad for these future innovations. You're positioning your institution to lead in what will be a much smarter, more connected financial world.

Ready to stop wrestling with documents and start closing deals faster? EDocGen provides a powerful, flexible platform to automate your entire commercial loan document lifecycle. Learn how EDocGen can transform your lending operations today .