Finance executives and accountants face enormous pressure to produce results at greater speed with accuracy in an increasingly complex regulatory environment that is subject to frequent audits and with ever-increasing volumes of documents. The creation and management of contracts, invoices, reports, or compliance disclosures remains one of the biggest pain points because it consumes so much wasteful resource effort and risk at every step.

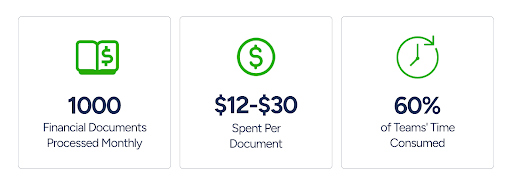

According to Gartner, large enterprise organizations handle about 10,000 financial documents a month at a processing cost of $12 to $30 per document. The time consumption is just as significant as the financial cost involved. Other studies by the American Productivity & Quality Center show that nearly 60% of the time of finance staff is spent on managing documents and data; thus, not much time is available for more strategic high-value tasks.

Manual, Repetitive Tasks: Creating financial documents from scratch or manual filling of existing templates consumes a significant amount of time that could be better utilized. Additionally, the manual process of extracting data from various systems to populate these templates raises the likelihood of errors and inconsistencies.

Error-Prone Processes: Human errors during document preparation can prove to be very expensive in terms of missteps, lead to fines on the wrong side of regulations, or even damage reputations. Studies have indicated that automation can reduce error rates up to 98%.

Compliance Nightmares: Increasingly active regulations (like FINRA, GDPR, SOX) demand careful documentation and audit trails. Inadequate manual tracking creates speed bumps and leaves gaps.

Workflow Bottlenecks: Approvals, signatures, and distributing documents typically hold up projects—especially when done through email or paper.

Lack of Integration: Legacy systems and siloed data make it very difficult to ensure documents are accurate, up-to-date, and accessible when needed.

Automation is the future for businesses seeking scalable, sustainable growth.

In this article, we’ll explore all aspects of document automation for finance, including what it is, why it’s essential, and how to implement it.

Automated document generation platforms are purpose-built to address these pain points by leveraging template-driven workflows, and seamless integrations with existing financial systems. Finance teams can uses this software to create, manage, and process financial documents with minimal human intervention.

The monthly, quarterly, and annual reporting cycles for finance executives and accountants are typically periods of intense pressure. It is a painstaking process to compile these statements manually; the Balance Sheet, Income Statement (Profit & Loss) and Cash Flow Statement. Keeping manual books is an error-prone process that often leads to delays. Automated document generation changes the landscape.

The ever-increasing complexity of financial regulations places a significant burden on finance and accounting teams. Preparing for audits and ensuring continuous compliance requires meticulous documentation. Automated document generation acts as a powerful ally by:

Manual expense reporting is a notorious pain point for both employees and finance teams. It's often characterized by lost receipts, illegible handwriting, and time-consuming reconciliation. Automated document generation brings order and efficiency:

Tax preparation and filing are critical but often complex and time-sensitive tasks for finance and accounting professionals. Errors can lead to penalties and compliance issues. Automated document generation provides a robust solution:

The benefits of financial document automation extend beyond efficiency gains and document creation, offering significant operational, compliance, security, and business advantages.

Below are some of the key advantages.

Operational benefits form the basis of financial document automation, enhancing efficiency, accuracy, and resource optimization.

|

Benefit |

What It Does |

|

Reduced Processing Time |

Automates routine tasks, standardizes workflows, scales operations, and optimizes resources. |

|

Improved Accuracy |

Eliminates manual errors, ensures validation, audits formulas, and applies uniform formats. |

|

Enhanced Productivity |

Automates workflows, accelerates productivity, boosts job satisfaction, and monitors performance. |

|

Lower Costs |

Reduces labor, error handling, and storage costs while streamlining processes. |

|

Operational Risk Reduction |

Standardizes workflows, secures document handling, ensures disaster recovery, and sends real-time alerts. |

|

Performance Optimization |

Tracks analytics, measures effectiveness, ensures continuous improvement, and optimizes resource utilization. |

Ensuring compliance and security protects sensitive data, promotes accountability, and minimizes risks while adhering to regulatory standards.

|

Benefit |

What It Does |

|

Automated Compliance Checks |

Ensures regulatory adherence by automating compliance checks and real-time updates. Prepares audit-ready documents consistently. |

|

Enhanced Data Security |

Implements end-to-end encryption, role-based access controls, and data masking to secure sensitive information. |

|

Complete Audit Trails |

Maintains detailed logs for accountability, compliance reporting, and traceability of all document changes. |

|

Reduced Compliance Risks |

Mitigates risks with policy enforcement and comprehensive audit trails to avoid non-compliance penalties. |

The business impact benefits drive strategic decision-making by enhancing overall customer satisfaction and gaining a competitive edge.

|

Benefit |

What It Does |

|

Better Cash Flow Management |

Provides real-time data access, trend analysis, and comprehensive reporting to support strategic insights and planning. |

|

Improved Customer Service |

Speeds up document processing ensures accuracy, and enhances transparency for better customer interactions. |

|

Enhanced Decision Making |

Offers real-time data, reliable analytics, and comprehensive reporting to support informed decisions. |

|

Competitive Advantage |

Delivers operational excellence, innovation leadership, and scalable market responsiveness and growth solutions. |

From optimizing workflows and enhancing security to driving business growth, these benefits highlight the significance of automation.

If you’re wondering how to achieve all this and more, let’s discuss eDocGen and how it could perfectly fit your organization.

Financial document automation requires precision, scalability, and integration with existing systems. EDocGen is a reliable solution designed specifically to address these challenges. It is a business user-friendly platform.

Below, we explore the capabilities that make it an ideal platform for businesses and institutions:

The platform is built to handle the complex demands of financial document automation, offering robust features that streamline processes and improve operational efficiency.

● Advanced Template Management: Centralized template library with version control, approval workflows, and support for complex layouts.

● Secure Data Integration: Integrates with financial systems to ensure real-time synchronization and data integrity.

● Multi-Format Support: Generates outputs in various formats (PDF, DOCX, XLSX) to meet diverse document requirements.

● Automated Workflows: Streamlines document lifecycles with predefined workflows, ensuring accuracy and compliance.

Security and compliance are critical in financial processes. eDocGen goes beyond industry standards to protect sensitive financial data and maintain regulatory adherence.

● Password Protection: Ensures secure access to financial documents with customizable password settings.

● Watermarking Options: Adds watermarks for document confidentiality and traceability.

● E-Signature Framework: Enables secure and legally binding digital signatures for financial agreements.

● Audit Trail Capabilities: Tracks all document interactions with detailed logs to meet compliance requirements.

The platform's comprehensive integration framework ensures smooth connectivity with financial systems, promoting efficient workflows and data consistency.

● REST API Support - Provides easy integration with custom systems and applications using APIs.

● Database Integration - Connects to SQL, NoSQL, and other databases for real-time data population.

● ERP/CRM Connectivity - Integrates with platforms like SAP, Oracle Financials, QuickBooks, and Xero.

● Cloud Storage Integration - Supports platforms like SharePoint and OneDrive for centralized document access.

These features and integrations have helped many organizations improve processes and achieve their goals.

This article has explored how financial document automation can address organizations' challenges in managing financial processes.

Here’s a brief takeaway on what automation can help you achieve:

● If your issue is time-consuming manual processes, automation can help you streamline document creation, approval, and distribution with efficient workflows.

● If your issue is high error rates in financial documents, automation can help you ensure accuracy with validation rules, formula auditing, and consistent data formatting.

● If your issue is compliance risks and audit challenges, automation can help you simplify adherence to regulations with built-in compliance checks, detailed audit trails, and secure storage.

● If your issue is limited scalability with manual systems, automation can help you manage high volumes effortlessly and support organizational growth.

● If your issue is data silos and lack of integration, automation can help you achieve integration with ERP, CRM, and accounting systems for real-time data synchronization.

EDocGen has already been trusted by financial institutions and businesses for its varied document automation capabilities. We take pride in providing solutions that meet the complex demands of financial document management, and we’d love to help you achieve the same.

To take the first step toward transforming your financial document processes, book demo with us.

Financial document automation improves compliance by:

● Standardizing processes,

● Maintaining detailed audit trails,

● Automatically applying regulatory requirements

It also reduces human error and enables real-time validation, simplifying compliance during audits.

Sensitive financial data is safeguarded through:

● End-to-end encryption for data in transit and at rest.

● Role-based access control with detailed permissions.

● Secure API connections with robust authentication protocols.

● Regular security audits and vulnerability assessments.

● Compliance with industry standards like GDPR and SOX.

● Comprehensive audit trails and activity monitoring.

Yes, it integrates in the following ways:

● Connecting with software like QuickBooks and Xero.

● Integrating ERP systems such as SAP and Oracle Financials.

● Using API-based integrations for custom systems.

● Synchronizing data in real-time for accuracy.

● Automating data validation and reconciliation.

The templates provide extensive customization, including:

● Flexible design tools for different document types.

● Support for complex calculations and business rules.

● Conditional content insertion based on data.

● Multi-language and multi-currency options.

● Brand-specific customization capabilities.

● Automatically converting and formatting currencies.

● Supporting various date and number formats.

● Providing multi-language capabilities for global operations.

● Allowing region-specific formatting rules.

● Ensuring standardized outputs across all formats.