Loan Documentation

Today there is a great digital revolution happening in the financial services

industry. More and more people are turning towards financial institutions

that exist mostly on a digital platform as opposed to brick-and-mortar.

FinTech has accelerated this push to bring the industry into a digital

environment.

Surprisingly, recent studies showed that it’s not just the younger generation,

but also a majority in the older age group also prefer digital

financial products. Digital loan processes provide enhanced

transparency and improved customer experience.

Historically, loan originators worked on manual document processes.

This increases the cost of originating loans. According to the Mortgage

Bankers Association, it reached $8,887 per loan in the first quarter of

2017. Effective use of technology can translate into less upfront work for

originators, more loans in the pipeline, faster closings, and happier

borrowers. This is a win-win for all stakeholders. Thus, a higher

number of loan originators are embracing digital loan processes.

Automate Loan Document Automation

Loan Documentation Software

Loan documentation software is the most cost-efficient digital

transformation for financial institutions. It streamlines the processes and generates great ROI in very short periods.

Loan document systems transcend the full range of borrowers, collateral,

and loan types, and enable the entire range of transactions to be digitized and

processed quickly including

-

The ability to produce applications for the loan request.

-

The functionality needed to create supporting application documents

including loan scenarios, where loan originators have to export complex

excel calculations into word/PDF documents.

-

Loan

originators can generate accurate loan document packages based on information

stored in LOS, CRM, and other front-end

platforms.

-

The ability to complete the loan document package with a commitment letter,

detailed borrowing resolutions, loan agreements, guarantees, promissory

notes, and security instruments - all with a high level of flexibility.

-

Go paperless by integrating loan documentation

software with an e-sign provider.

This

enhances the borrower experience while making the back-end loan-production

process more efficient and effective by allowing lenders to produce

higher-quality loan files in less time.

Choosing the right loan documentation software is critical. One of the most common approaches

for automating loan document creation is by coding the

templates in the core system. This is expensive and maintenance-heavy. Moreover, document

templates undergo frequent changes and thus require associated code changes whenever there is

a change in the templates.

This makes business users ever dependent on resource-constrained IT departments.

EDocGen Loan Documentation Software

It is the fastest and the simplest way to auto-generate documents and

was specifically developed for auto-generating loan documentation. It is a

DIY loan documentation software with an intuitive interface. You can generate

loan documents from both your PDF and Microsoft Word templates.

Your business users

can create/edit templates in their favorite Microsoft Word/PDF editors. Thus it

empowers them to have complete control over template changes.

-

EDocGen seamlessly integrates with the industry’s leading loan

origination, point-of-sale, and borrower portals through Rest API, removing the need to

re-key the data into templates.

-

100% of text can be customized for all transaction types.

-

Standard Microsoft Word (Docx) and PDF documents output.

-

Perform if-else conditions and calculations right inside templates.

-

Available as a subscription service that doesn't involve large upfront

fees or multiple-year contractual lock-ins.

One of the biggest bottlenecks in the lending process is document collection. Many organizations

still turn to email for requesting and collecting documents from customers to complete the loan application process.

This wastes loan officers' and administrators' productivity.

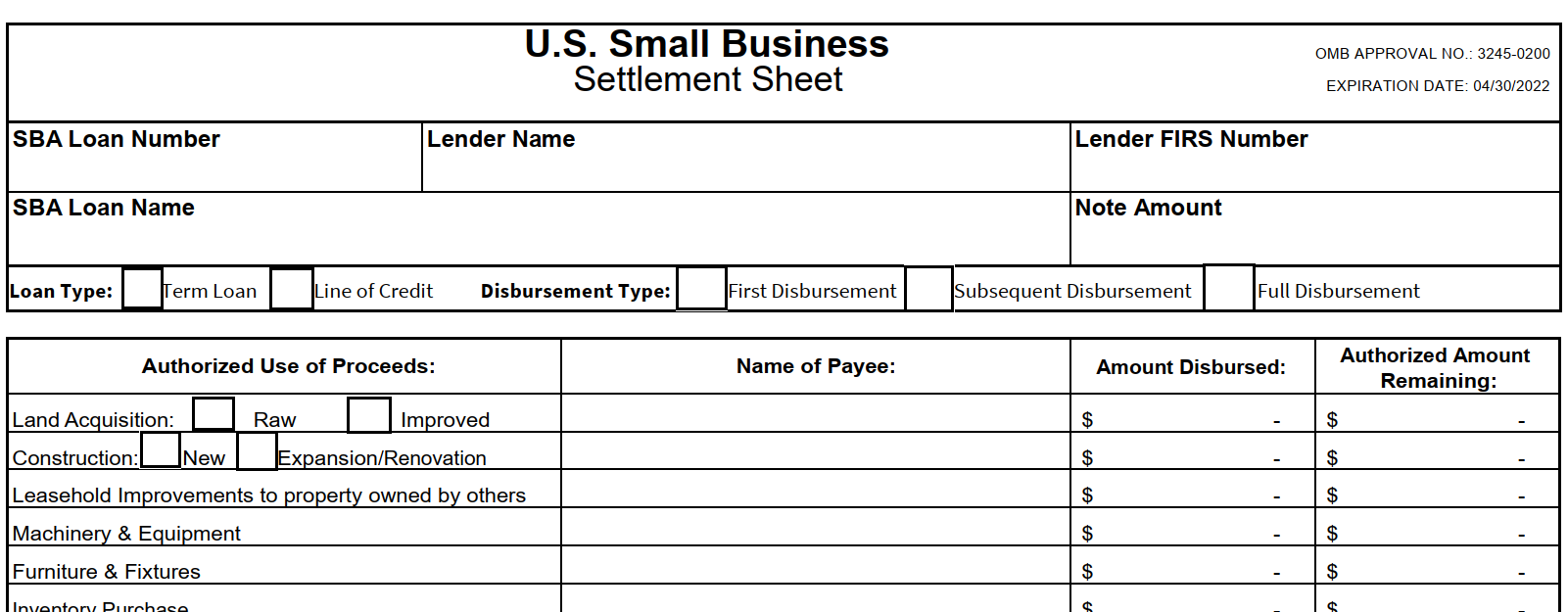

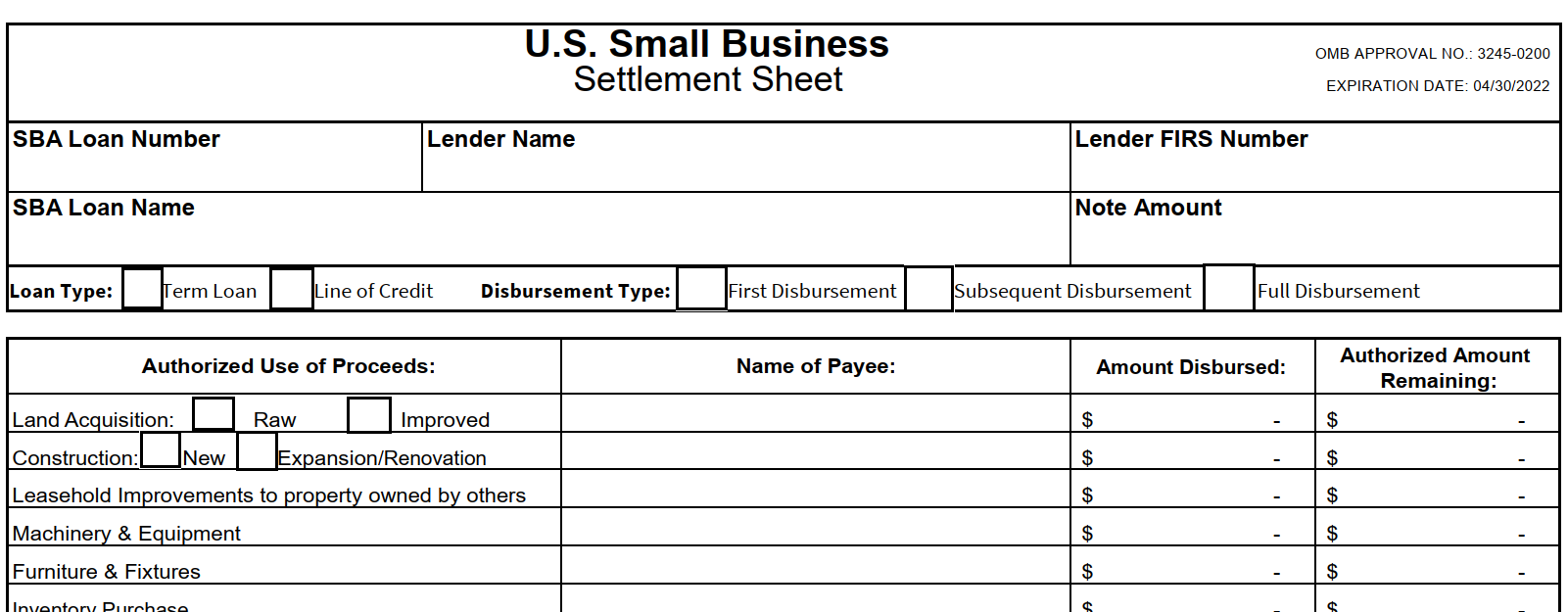

Using EDocGen, business users can auto-generate fillable forms from existing loan templates. Customers can

access these forms online. They can fill out these forms,

E-Sign, and upload supporting documents before submitting the forms. The system populates the

form data into the templates to generate loan packages. This

increases loan processing capacity and improves customer experience.

Using EDocGen loan documentation software, you can achieve speed,

convenience, efficiency, customer experience and engagement, reduced risk,

and improved compliance.